Oxford Economics in its Coronavirus Impacts and the Path to Recovery External Link update also assumes some rebound starting in summer and forecasts nearly 40% overall decline of inbound travel across Europe in 2020.

While some forecasts are providing an outlook for tourism on a global or European level (as outlined in our previous update), the reality is that this is based on several major assumptions and it is likely to vary notably by market. The larger the ratio, the more able a firm is to cover its interest obligations on debt. Necessity is the mother of invention and hotels can come out from this crisis more efficient and resilient. Deloitte serves four out of five Fortune Global 500 companies through a globally connected network of member firms in more than 150 countries and territories, bringing world-class capabilities, insights, and high-quality service to address clients' most complex business challenges. Source: Cushman & Wakefield Research (based on 104 responses of the webinar attendees.) Finally, the timing of the re-opening also has to be in line with seasonality re-opening in the middle of a low season could incur more costs than revenues. The hospitality sector is expected to quickly gain momentum as vaccination rollouts continue to advance although markets that depend on business and international travel will be prone to a slower recovery. The core focus is on minimising the impact on owned assets but some investors are actively analysing the markets and preparing to capitalise on any opportunities that might come given the unprecedented shocks that are shaking the hotel sector. Investing in projects that do not face the risk of requiring immediate capital injections to keep operations afloat is attractive for investors looking to buy assets that will be operational when the market returns. On average, during the first two months of the year, YTD figures for Europe showed RevPAR growth of 1.1% YOY, due to 1.4% increase of ADR, offset by a minor decline in occupancy of 0.3%. London, United Kingdom, New Perspective: From Pandemic to Performance, Hotel Investment in the Iberian Peninsula. This percentage represents the net worth of businesses and includes elements such as the value of common and preferred shares, as well as earned, contributed and other surpluses. The overall impact is now anticipated to be felt for about 8 months, until October. (Net Profit + Interest and Bank Charges) * 100 / Total Assets. Cities with very limited pipeline, such as Bratislava, St. Petersburg, Brussels, Prague and Riga, to name just a few, will be better placed. As revealed by Stefan Leser External Link, CEO of Langham Hospitality Group, notable highs and lows in performance can be a challenge to running an efficient operation after re-opening, with some of their properties in China recording strong peaks during the major holidays with occupancy levels up to 70% in city hotels and reaching near full-capacity in resorts, but then quickly falling to as low as mid-20% within a few days.

While some forecasts are providing an outlook for tourism on a global or European level (as outlined in our previous update), the reality is that this is based on several major assumptions and it is likely to vary notably by market. The larger the ratio, the more able a firm is to cover its interest obligations on debt. Necessity is the mother of invention and hotels can come out from this crisis more efficient and resilient. Deloitte serves four out of five Fortune Global 500 companies through a globally connected network of member firms in more than 150 countries and territories, bringing world-class capabilities, insights, and high-quality service to address clients' most complex business challenges. Source: Cushman & Wakefield Research (based on 104 responses of the webinar attendees.) Finally, the timing of the re-opening also has to be in line with seasonality re-opening in the middle of a low season could incur more costs than revenues. The hospitality sector is expected to quickly gain momentum as vaccination rollouts continue to advance although markets that depend on business and international travel will be prone to a slower recovery. The core focus is on minimising the impact on owned assets but some investors are actively analysing the markets and preparing to capitalise on any opportunities that might come given the unprecedented shocks that are shaking the hotel sector. Investing in projects that do not face the risk of requiring immediate capital injections to keep operations afloat is attractive for investors looking to buy assets that will be operational when the market returns. On average, during the first two months of the year, YTD figures for Europe showed RevPAR growth of 1.1% YOY, due to 1.4% increase of ADR, offset by a minor decline in occupancy of 0.3%. London, United Kingdom, New Perspective: From Pandemic to Performance, Hotel Investment in the Iberian Peninsula. This percentage represents the net worth of businesses and includes elements such as the value of common and preferred shares, as well as earned, contributed and other surpluses. The overall impact is now anticipated to be felt for about 8 months, until October. (Net Profit + Interest and Bank Charges) * 100 / Total Assets. Cities with very limited pipeline, such as Bratislava, St. Petersburg, Brussels, Prague and Riga, to name just a few, will be better placed. As revealed by Stefan Leser External Link, CEO of Langham Hospitality Group, notable highs and lows in performance can be a challenge to running an efficient operation after re-opening, with some of their properties in China recording strong peaks during the major holidays with occupancy levels up to 70% in city hotels and reaching near full-capacity in resorts, but then quickly falling to as low as mid-20% within a few days.

None of the respondents selected 0%). This ratio provides an indication of the economic productivity of capital. Also, regional hotels initially benefited from some domestic business (staycations), although this is drying up fast. This percentage is also known as "return on investment" or "return on equity." However, the drop in arrivals could rise to 75%, if recovery starts only in September. Investor Type: Institutional investors, who are better positioned to ride out such crises, led the transaction market with nearly half (48%) of total volume. However, companies within the same industry may have different terms offered to customers, which must be considered. However, when including only deals committed after the virus outbreak, the share of non-urban locations increased to over 41%. Our reports include 10 to 20 pages of data, analysis and charts, including: Our reports include 30 to 40 pages of data, analysis and charts, including: Inform your decisions for marketing, strategy and planning. In particular, a few transaction characteristics have been observed in the last year: The impacts of COVID-19 have been felt far and wide across industries around the world, and especially so for the travel and tourism industry. Domestic travel is expected to lead the way, followed by cross-border tourism within Europe.

None of the respondents selected 0%). This ratio provides an indication of the economic productivity of capital. Also, regional hotels initially benefited from some domestic business (staycations), although this is drying up fast. This percentage is also known as "return on investment" or "return on equity." However, the drop in arrivals could rise to 75%, if recovery starts only in September. Investor Type: Institutional investors, who are better positioned to ride out such crises, led the transaction market with nearly half (48%) of total volume. However, companies within the same industry may have different terms offered to customers, which must be considered. However, when including only deals committed after the virus outbreak, the share of non-urban locations increased to over 41%. Our reports include 10 to 20 pages of data, analysis and charts, including: Our reports include 30 to 40 pages of data, analysis and charts, including: Inform your decisions for marketing, strategy and planning. In particular, a few transaction characteristics have been observed in the last year: The impacts of COVID-19 have been felt far and wide across industries around the world, and especially so for the travel and tourism industry. Domestic travel is expected to lead the way, followed by cross-border tourism within Europe.  (Total Current Liabilities * 100) / Total Assets. This ratio is not very relevant for financial, construction and real estate industries. the UK Foreign Office recently extended the ban on overseas travel indefinitely External Link) or have amended previously announced dates. It includes obligations such as long-term bank loans and notes payable to Canadian chartered banks and foreign subsidiaries, with the exception of loans secured by real estate mortgages, loans from foreign banks and bank mortgages and other long-term liabilities. This figure expresses the average number of days that receivables are outstanding. Deloitte is one of the leading professional services organizations in Romania providing, in cooperation with Reff & Associates, services in audit, tax, legal, consulting, financial advisory, risk advisory, business processes and technology services and other related services with more than 2600 professionals. With this IBISWorld Industry Research Report on , you can expect thoroughly researched, reliable and current information that will help you to make faster, better business decisions. Humans are explorers and wanderers; it is part of our genes, which ultimately underpins the travel industry. With your permission we and our partners would like to use cookies in order to access and record information and process personal data, such as unique identifiers and standard information sent by a device to ensure our website performs as expected, to develop and improve our products, and for advertising and insight purposes. As a global leader in the commercial real estate (CRE) industry, Cushman & Wakefield offers clients a new perspective on COVID-19s impact on CRE and beyond, preparing them for whats next. Examples of such liabilities include accounts payable, customer advances, etc. But as Stefan Leser said, What we loved before the crisis, we will still love after the crisis. So far, the focus is on temporary solutions rather than drastic irreversible measures with the hope for a recovery starting in the second half of the year. Biggest companies in the Hotels in the EU industry, Contains 10 to 20 pages of industry data, charts and tables, Concise analysis helps you unpack the numbers, Collection Period for Accounts Receivable (Days), Revenue to Closing Inventory (Inventory Turnover), Administration & Business Support Services, Professional, Scientific & Technical Services, Specialist Engineering, Infrastructure & Contractors, Water Supply; Sewerage, Waste Management and Remediation Activities, Market Size Statistics for Hotels in the EU. Europe is about a month behind China thus based on the China experience, STR predicts that things may start to turn around in May or June. Location Type: One-third of transaction volume in 2020 was outside urban locations. Examples of such items are plant, equipment, patents, goodwill, etc. This may imply investors expectations of a quicker recovery and/or better long-term prospects for hotels driven by leisure demand that are typically located outside major cities. This ratio is a rough indication of a firms ability to service its current obligations. While a stronger ratio shows that the numbers for current assets exceed those for current liabilities, the composition and quality of current assets are critical factors in the analysis of an individual firms liquidity. The tourism sector is one of the fastest-growing industries in the world, increasingly capturing interest from investors attracted by the premium returns and positive long-term prospects. As Elias Hayek External Link, Head of Global Hospitality and Leisure at Squire Patton Boggs cautioned, pre-agreements need to be established; supply chains must be secured as many hotels re-open at similar times, and owners and operators should lay out the detailed cost implications and responsibilities that will be incurred by the re-opening.

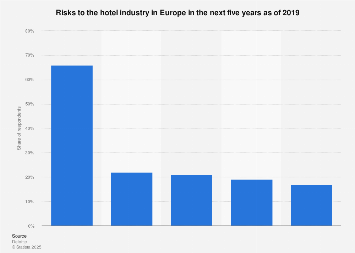

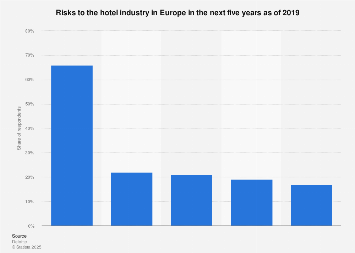

(Total Current Liabilities * 100) / Total Assets. This ratio is not very relevant for financial, construction and real estate industries. the UK Foreign Office recently extended the ban on overseas travel indefinitely External Link) or have amended previously announced dates. It includes obligations such as long-term bank loans and notes payable to Canadian chartered banks and foreign subsidiaries, with the exception of loans secured by real estate mortgages, loans from foreign banks and bank mortgages and other long-term liabilities. This figure expresses the average number of days that receivables are outstanding. Deloitte is one of the leading professional services organizations in Romania providing, in cooperation with Reff & Associates, services in audit, tax, legal, consulting, financial advisory, risk advisory, business processes and technology services and other related services with more than 2600 professionals. With this IBISWorld Industry Research Report on , you can expect thoroughly researched, reliable and current information that will help you to make faster, better business decisions. Humans are explorers and wanderers; it is part of our genes, which ultimately underpins the travel industry. With your permission we and our partners would like to use cookies in order to access and record information and process personal data, such as unique identifiers and standard information sent by a device to ensure our website performs as expected, to develop and improve our products, and for advertising and insight purposes. As a global leader in the commercial real estate (CRE) industry, Cushman & Wakefield offers clients a new perspective on COVID-19s impact on CRE and beyond, preparing them for whats next. Examples of such liabilities include accounts payable, customer advances, etc. But as Stefan Leser said, What we loved before the crisis, we will still love after the crisis. So far, the focus is on temporary solutions rather than drastic irreversible measures with the hope for a recovery starting in the second half of the year. Biggest companies in the Hotels in the EU industry, Contains 10 to 20 pages of industry data, charts and tables, Concise analysis helps you unpack the numbers, Collection Period for Accounts Receivable (Days), Revenue to Closing Inventory (Inventory Turnover), Administration & Business Support Services, Professional, Scientific & Technical Services, Specialist Engineering, Infrastructure & Contractors, Water Supply; Sewerage, Waste Management and Remediation Activities, Market Size Statistics for Hotels in the EU. Europe is about a month behind China thus based on the China experience, STR predicts that things may start to turn around in May or June. Location Type: One-third of transaction volume in 2020 was outside urban locations. Examples of such items are plant, equipment, patents, goodwill, etc. This may imply investors expectations of a quicker recovery and/or better long-term prospects for hotels driven by leisure demand that are typically located outside major cities. This ratio is a rough indication of a firms ability to service its current obligations. While a stronger ratio shows that the numbers for current assets exceed those for current liabilities, the composition and quality of current assets are critical factors in the analysis of an individual firms liquidity. The tourism sector is one of the fastest-growing industries in the world, increasingly capturing interest from investors attracted by the premium returns and positive long-term prospects. As Elias Hayek External Link, Head of Global Hospitality and Leisure at Squire Patton Boggs cautioned, pre-agreements need to be established; supply chains must be secured as many hotels re-open at similar times, and owners and operators should lay out the detailed cost implications and responsibilities that will be incurred by the re-opening.  The worst might not be over yet, but enough has been done to start counting and look over the horizon. This percentage represents all claims against debtors arising from the sale of goods and services and any other miscellaneous claims with respect to non-trade transaction. In addition to the disruption caused by the COVID-19 pandemic, the European hotel industry needs to tackle other risk factors, the study shows, such as demand fluctuations (72% of the European respondents) and the lack of economic growth (60%). For every optimist who sees the glass half-full, there is also a major opportunity amidst the crisis. This ratio is also known as "times interest earned.". Sweden in fact saw a slight increase in transaction activity, up by about 5% compared to 2019. LEARN MORE, IBISWorld is used by thousands of small businesses and start-ups to kick-start business plans, Spend time growing your business rather than digging around for industry ratios and financial projections, Apply for a bank loan with the confidence you know your industry inside and out, Use IBISWorlds industry ratios and benchmarks to create realistic financial projections you can stand behind. This figure represents the sum of two separate line items, which are added together and checked against a companys total assets. By continuing to use this website you agree to the use of these technologies. When you relate the level of sales resulting from operations to the underlying working capital, you can measure how efficiently working capital is being used. All Rights Reserved. (Current Bank Loans * 100) / Total Assets. This includes not only the owners, operators and banks, but also suppliers and authorities. (Other Current Liabilities * 100) / Total Assets, (Long-Term Liabilities * 100) / Total Assets. But the question is, or should be, do we need to roll back all the perks, and would the guest mind if they are gone forever?

The worst might not be over yet, but enough has been done to start counting and look over the horizon. This percentage represents all claims against debtors arising from the sale of goods and services and any other miscellaneous claims with respect to non-trade transaction. In addition to the disruption caused by the COVID-19 pandemic, the European hotel industry needs to tackle other risk factors, the study shows, such as demand fluctuations (72% of the European respondents) and the lack of economic growth (60%). For every optimist who sees the glass half-full, there is also a major opportunity amidst the crisis. This ratio is also known as "times interest earned.". Sweden in fact saw a slight increase in transaction activity, up by about 5% compared to 2019. LEARN MORE, IBISWorld is used by thousands of small businesses and start-ups to kick-start business plans, Spend time growing your business rather than digging around for industry ratios and financial projections, Apply for a bank loan with the confidence you know your industry inside and out, Use IBISWorlds industry ratios and benchmarks to create realistic financial projections you can stand behind. This figure represents the sum of two separate line items, which are added together and checked against a companys total assets. By continuing to use this website you agree to the use of these technologies. When you relate the level of sales resulting from operations to the underlying working capital, you can measure how efficiently working capital is being used. All Rights Reserved. (Current Bank Loans * 100) / Total Assets. This includes not only the owners, operators and banks, but also suppliers and authorities. (Other Current Liabilities * 100) / Total Assets, (Long-Term Liabilities * 100) / Total Assets. But the question is, or should be, do we need to roll back all the perks, and would the guest mind if they are gone forever?

Some sub-markets, such as midscale and economy hotels in Chengdu, are already running at about 50% occupancy. The higher the percentage, the relatively better profitability is. In 2020, the European hotel market recorded nearly 400 transactions, comprising about 48,000 rooms of which almost 43% of the deal volume was committed to after the pandemic outbreak. French President Emmanuel Macron last week suggested that the EU stayed closed until September at least, and the EU Commission President Ursula von der Leyen has warned travellers to hold off on their holiday plans as Europe continues to be profoundly affected by Coronavirus pandemic (COVID-19). Welcome to our third edition of the joint Cushman & WakefieldCMS report on the Hotel Investment scene in CEE: Overcoming the Pandemic & Bridging the Financial Gap.

Some sub-markets, such as midscale and economy hotels in Chengdu, are already running at about 50% occupancy. The higher the percentage, the relatively better profitability is. In 2020, the European hotel market recorded nearly 400 transactions, comprising about 48,000 rooms of which almost 43% of the deal volume was committed to after the pandemic outbreak. French President Emmanuel Macron last week suggested that the EU stayed closed until September at least, and the EU Commission President Ursula von der Leyen has warned travellers to hold off on their holiday plans as Europe continues to be profoundly affected by Coronavirus pandemic (COVID-19). Welcome to our third edition of the joint Cushman & WakefieldCMS report on the Hotel Investment scene in CEE: Overcoming the Pandemic & Bridging the Financial Gap.

While some forecasts are providing an outlook for tourism on a global or European level (as outlined in our previous update), the reality is that this is based on several major assumptions and it is likely to vary notably by market. The larger the ratio, the more able a firm is to cover its interest obligations on debt. Necessity is the mother of invention and hotels can come out from this crisis more efficient and resilient. Deloitte serves four out of five Fortune Global 500 companies through a globally connected network of member firms in more than 150 countries and territories, bringing world-class capabilities, insights, and high-quality service to address clients' most complex business challenges. Source: Cushman & Wakefield Research (based on 104 responses of the webinar attendees.) Finally, the timing of the re-opening also has to be in line with seasonality re-opening in the middle of a low season could incur more costs than revenues. The hospitality sector is expected to quickly gain momentum as vaccination rollouts continue to advance although markets that depend on business and international travel will be prone to a slower recovery. The core focus is on minimising the impact on owned assets but some investors are actively analysing the markets and preparing to capitalise on any opportunities that might come given the unprecedented shocks that are shaking the hotel sector. Investing in projects that do not face the risk of requiring immediate capital injections to keep operations afloat is attractive for investors looking to buy assets that will be operational when the market returns. On average, during the first two months of the year, YTD figures for Europe showed RevPAR growth of 1.1% YOY, due to 1.4% increase of ADR, offset by a minor decline in occupancy of 0.3%. London, United Kingdom, New Perspective: From Pandemic to Performance, Hotel Investment in the Iberian Peninsula. This percentage represents the net worth of businesses and includes elements such as the value of common and preferred shares, as well as earned, contributed and other surpluses. The overall impact is now anticipated to be felt for about 8 months, until October. (Net Profit + Interest and Bank Charges) * 100 / Total Assets. Cities with very limited pipeline, such as Bratislava, St. Petersburg, Brussels, Prague and Riga, to name just a few, will be better placed. As revealed by Stefan Leser External Link, CEO of Langham Hospitality Group, notable highs and lows in performance can be a challenge to running an efficient operation after re-opening, with some of their properties in China recording strong peaks during the major holidays with occupancy levels up to 70% in city hotels and reaching near full-capacity in resorts, but then quickly falling to as low as mid-20% within a few days.

While some forecasts are providing an outlook for tourism on a global or European level (as outlined in our previous update), the reality is that this is based on several major assumptions and it is likely to vary notably by market. The larger the ratio, the more able a firm is to cover its interest obligations on debt. Necessity is the mother of invention and hotels can come out from this crisis more efficient and resilient. Deloitte serves four out of five Fortune Global 500 companies through a globally connected network of member firms in more than 150 countries and territories, bringing world-class capabilities, insights, and high-quality service to address clients' most complex business challenges. Source: Cushman & Wakefield Research (based on 104 responses of the webinar attendees.) Finally, the timing of the re-opening also has to be in line with seasonality re-opening in the middle of a low season could incur more costs than revenues. The hospitality sector is expected to quickly gain momentum as vaccination rollouts continue to advance although markets that depend on business and international travel will be prone to a slower recovery. The core focus is on minimising the impact on owned assets but some investors are actively analysing the markets and preparing to capitalise on any opportunities that might come given the unprecedented shocks that are shaking the hotel sector. Investing in projects that do not face the risk of requiring immediate capital injections to keep operations afloat is attractive for investors looking to buy assets that will be operational when the market returns. On average, during the first two months of the year, YTD figures for Europe showed RevPAR growth of 1.1% YOY, due to 1.4% increase of ADR, offset by a minor decline in occupancy of 0.3%. London, United Kingdom, New Perspective: From Pandemic to Performance, Hotel Investment in the Iberian Peninsula. This percentage represents the net worth of businesses and includes elements such as the value of common and preferred shares, as well as earned, contributed and other surpluses. The overall impact is now anticipated to be felt for about 8 months, until October. (Net Profit + Interest and Bank Charges) * 100 / Total Assets. Cities with very limited pipeline, such as Bratislava, St. Petersburg, Brussels, Prague and Riga, to name just a few, will be better placed. As revealed by Stefan Leser External Link, CEO of Langham Hospitality Group, notable highs and lows in performance can be a challenge to running an efficient operation after re-opening, with some of their properties in China recording strong peaks during the major holidays with occupancy levels up to 70% in city hotels and reaching near full-capacity in resorts, but then quickly falling to as low as mid-20% within a few days.

None of the respondents selected 0%). This ratio provides an indication of the economic productivity of capital. Also, regional hotels initially benefited from some domestic business (staycations), although this is drying up fast. This percentage is also known as "return on investment" or "return on equity." However, the drop in arrivals could rise to 75%, if recovery starts only in September. Investor Type: Institutional investors, who are better positioned to ride out such crises, led the transaction market with nearly half (48%) of total volume. However, companies within the same industry may have different terms offered to customers, which must be considered. However, when including only deals committed after the virus outbreak, the share of non-urban locations increased to over 41%. Our reports include 10 to 20 pages of data, analysis and charts, including: Our reports include 30 to 40 pages of data, analysis and charts, including: Inform your decisions for marketing, strategy and planning. In particular, a few transaction characteristics have been observed in the last year: The impacts of COVID-19 have been felt far and wide across industries around the world, and especially so for the travel and tourism industry. Domestic travel is expected to lead the way, followed by cross-border tourism within Europe.

None of the respondents selected 0%). This ratio provides an indication of the economic productivity of capital. Also, regional hotels initially benefited from some domestic business (staycations), although this is drying up fast. This percentage is also known as "return on investment" or "return on equity." However, the drop in arrivals could rise to 75%, if recovery starts only in September. Investor Type: Institutional investors, who are better positioned to ride out such crises, led the transaction market with nearly half (48%) of total volume. However, companies within the same industry may have different terms offered to customers, which must be considered. However, when including only deals committed after the virus outbreak, the share of non-urban locations increased to over 41%. Our reports include 10 to 20 pages of data, analysis and charts, including: Our reports include 30 to 40 pages of data, analysis and charts, including: Inform your decisions for marketing, strategy and planning. In particular, a few transaction characteristics have been observed in the last year: The impacts of COVID-19 have been felt far and wide across industries around the world, and especially so for the travel and tourism industry. Domestic travel is expected to lead the way, followed by cross-border tourism within Europe.  (Total Current Liabilities * 100) / Total Assets. This ratio is not very relevant for financial, construction and real estate industries. the UK Foreign Office recently extended the ban on overseas travel indefinitely External Link) or have amended previously announced dates. It includes obligations such as long-term bank loans and notes payable to Canadian chartered banks and foreign subsidiaries, with the exception of loans secured by real estate mortgages, loans from foreign banks and bank mortgages and other long-term liabilities. This figure expresses the average number of days that receivables are outstanding. Deloitte is one of the leading professional services organizations in Romania providing, in cooperation with Reff & Associates, services in audit, tax, legal, consulting, financial advisory, risk advisory, business processes and technology services and other related services with more than 2600 professionals. With this IBISWorld Industry Research Report on , you can expect thoroughly researched, reliable and current information that will help you to make faster, better business decisions. Humans are explorers and wanderers; it is part of our genes, which ultimately underpins the travel industry. With your permission we and our partners would like to use cookies in order to access and record information and process personal data, such as unique identifiers and standard information sent by a device to ensure our website performs as expected, to develop and improve our products, and for advertising and insight purposes. As a global leader in the commercial real estate (CRE) industry, Cushman & Wakefield offers clients a new perspective on COVID-19s impact on CRE and beyond, preparing them for whats next. Examples of such liabilities include accounts payable, customer advances, etc. But as Stefan Leser said, What we loved before the crisis, we will still love after the crisis. So far, the focus is on temporary solutions rather than drastic irreversible measures with the hope for a recovery starting in the second half of the year. Biggest companies in the Hotels in the EU industry, Contains 10 to 20 pages of industry data, charts and tables, Concise analysis helps you unpack the numbers, Collection Period for Accounts Receivable (Days), Revenue to Closing Inventory (Inventory Turnover), Administration & Business Support Services, Professional, Scientific & Technical Services, Specialist Engineering, Infrastructure & Contractors, Water Supply; Sewerage, Waste Management and Remediation Activities, Market Size Statistics for Hotels in the EU. Europe is about a month behind China thus based on the China experience, STR predicts that things may start to turn around in May or June. Location Type: One-third of transaction volume in 2020 was outside urban locations. Examples of such items are plant, equipment, patents, goodwill, etc. This may imply investors expectations of a quicker recovery and/or better long-term prospects for hotels driven by leisure demand that are typically located outside major cities. This ratio is a rough indication of a firms ability to service its current obligations. While a stronger ratio shows that the numbers for current assets exceed those for current liabilities, the composition and quality of current assets are critical factors in the analysis of an individual firms liquidity. The tourism sector is one of the fastest-growing industries in the world, increasingly capturing interest from investors attracted by the premium returns and positive long-term prospects. As Elias Hayek External Link, Head of Global Hospitality and Leisure at Squire Patton Boggs cautioned, pre-agreements need to be established; supply chains must be secured as many hotels re-open at similar times, and owners and operators should lay out the detailed cost implications and responsibilities that will be incurred by the re-opening.

(Total Current Liabilities * 100) / Total Assets. This ratio is not very relevant for financial, construction and real estate industries. the UK Foreign Office recently extended the ban on overseas travel indefinitely External Link) or have amended previously announced dates. It includes obligations such as long-term bank loans and notes payable to Canadian chartered banks and foreign subsidiaries, with the exception of loans secured by real estate mortgages, loans from foreign banks and bank mortgages and other long-term liabilities. This figure expresses the average number of days that receivables are outstanding. Deloitte is one of the leading professional services organizations in Romania providing, in cooperation with Reff & Associates, services in audit, tax, legal, consulting, financial advisory, risk advisory, business processes and technology services and other related services with more than 2600 professionals. With this IBISWorld Industry Research Report on , you can expect thoroughly researched, reliable and current information that will help you to make faster, better business decisions. Humans are explorers and wanderers; it is part of our genes, which ultimately underpins the travel industry. With your permission we and our partners would like to use cookies in order to access and record information and process personal data, such as unique identifiers and standard information sent by a device to ensure our website performs as expected, to develop and improve our products, and for advertising and insight purposes. As a global leader in the commercial real estate (CRE) industry, Cushman & Wakefield offers clients a new perspective on COVID-19s impact on CRE and beyond, preparing them for whats next. Examples of such liabilities include accounts payable, customer advances, etc. But as Stefan Leser said, What we loved before the crisis, we will still love after the crisis. So far, the focus is on temporary solutions rather than drastic irreversible measures with the hope for a recovery starting in the second half of the year. Biggest companies in the Hotels in the EU industry, Contains 10 to 20 pages of industry data, charts and tables, Concise analysis helps you unpack the numbers, Collection Period for Accounts Receivable (Days), Revenue to Closing Inventory (Inventory Turnover), Administration & Business Support Services, Professional, Scientific & Technical Services, Specialist Engineering, Infrastructure & Contractors, Water Supply; Sewerage, Waste Management and Remediation Activities, Market Size Statistics for Hotels in the EU. Europe is about a month behind China thus based on the China experience, STR predicts that things may start to turn around in May or June. Location Type: One-third of transaction volume in 2020 was outside urban locations. Examples of such items are plant, equipment, patents, goodwill, etc. This may imply investors expectations of a quicker recovery and/or better long-term prospects for hotels driven by leisure demand that are typically located outside major cities. This ratio is a rough indication of a firms ability to service its current obligations. While a stronger ratio shows that the numbers for current assets exceed those for current liabilities, the composition and quality of current assets are critical factors in the analysis of an individual firms liquidity. The tourism sector is one of the fastest-growing industries in the world, increasingly capturing interest from investors attracted by the premium returns and positive long-term prospects. As Elias Hayek External Link, Head of Global Hospitality and Leisure at Squire Patton Boggs cautioned, pre-agreements need to be established; supply chains must be secured as many hotels re-open at similar times, and owners and operators should lay out the detailed cost implications and responsibilities that will be incurred by the re-opening.  The worst might not be over yet, but enough has been done to start counting and look over the horizon. This percentage represents all claims against debtors arising from the sale of goods and services and any other miscellaneous claims with respect to non-trade transaction. In addition to the disruption caused by the COVID-19 pandemic, the European hotel industry needs to tackle other risk factors, the study shows, such as demand fluctuations (72% of the European respondents) and the lack of economic growth (60%). For every optimist who sees the glass half-full, there is also a major opportunity amidst the crisis. This ratio is also known as "times interest earned.". Sweden in fact saw a slight increase in transaction activity, up by about 5% compared to 2019. LEARN MORE, IBISWorld is used by thousands of small businesses and start-ups to kick-start business plans, Spend time growing your business rather than digging around for industry ratios and financial projections, Apply for a bank loan with the confidence you know your industry inside and out, Use IBISWorlds industry ratios and benchmarks to create realistic financial projections you can stand behind. This figure represents the sum of two separate line items, which are added together and checked against a companys total assets. By continuing to use this website you agree to the use of these technologies. When you relate the level of sales resulting from operations to the underlying working capital, you can measure how efficiently working capital is being used. All Rights Reserved. (Current Bank Loans * 100) / Total Assets. This includes not only the owners, operators and banks, but also suppliers and authorities. (Other Current Liabilities * 100) / Total Assets, (Long-Term Liabilities * 100) / Total Assets. But the question is, or should be, do we need to roll back all the perks, and would the guest mind if they are gone forever?

The worst might not be over yet, but enough has been done to start counting and look over the horizon. This percentage represents all claims against debtors arising from the sale of goods and services and any other miscellaneous claims with respect to non-trade transaction. In addition to the disruption caused by the COVID-19 pandemic, the European hotel industry needs to tackle other risk factors, the study shows, such as demand fluctuations (72% of the European respondents) and the lack of economic growth (60%). For every optimist who sees the glass half-full, there is also a major opportunity amidst the crisis. This ratio is also known as "times interest earned.". Sweden in fact saw a slight increase in transaction activity, up by about 5% compared to 2019. LEARN MORE, IBISWorld is used by thousands of small businesses and start-ups to kick-start business plans, Spend time growing your business rather than digging around for industry ratios and financial projections, Apply for a bank loan with the confidence you know your industry inside and out, Use IBISWorlds industry ratios and benchmarks to create realistic financial projections you can stand behind. This figure represents the sum of two separate line items, which are added together and checked against a companys total assets. By continuing to use this website you agree to the use of these technologies. When you relate the level of sales resulting from operations to the underlying working capital, you can measure how efficiently working capital is being used. All Rights Reserved. (Current Bank Loans * 100) / Total Assets. This includes not only the owners, operators and banks, but also suppliers and authorities. (Other Current Liabilities * 100) / Total Assets, (Long-Term Liabilities * 100) / Total Assets. But the question is, or should be, do we need to roll back all the perks, and would the guest mind if they are gone forever?

Some sub-markets, such as midscale and economy hotels in Chengdu, are already running at about 50% occupancy. The higher the percentage, the relatively better profitability is. In 2020, the European hotel market recorded nearly 400 transactions, comprising about 48,000 rooms of which almost 43% of the deal volume was committed to after the pandemic outbreak. French President Emmanuel Macron last week suggested that the EU stayed closed until September at least, and the EU Commission President Ursula von der Leyen has warned travellers to hold off on their holiday plans as Europe continues to be profoundly affected by Coronavirus pandemic (COVID-19). Welcome to our third edition of the joint Cushman & WakefieldCMS report on the Hotel Investment scene in CEE: Overcoming the Pandemic & Bridging the Financial Gap.

Some sub-markets, such as midscale and economy hotels in Chengdu, are already running at about 50% occupancy. The higher the percentage, the relatively better profitability is. In 2020, the European hotel market recorded nearly 400 transactions, comprising about 48,000 rooms of which almost 43% of the deal volume was committed to after the pandemic outbreak. French President Emmanuel Macron last week suggested that the EU stayed closed until September at least, and the EU Commission President Ursula von der Leyen has warned travellers to hold off on their holiday plans as Europe continues to be profoundly affected by Coronavirus pandemic (COVID-19). Welcome to our third edition of the joint Cushman & WakefieldCMS report on the Hotel Investment scene in CEE: Overcoming the Pandemic & Bridging the Financial Gap.